Crafting Investment Outcomes

Derivatives expertise. Wall Street rigor. Silicon Valley ingenuity.

Built for outcomes

Engineered Precision

Define growth parameters, protection buffers, and income targets upfront—know your targeted outcomes before you invest.

Outcomes that Seek to Deliver

Every product seeks to provide the outcome that it’s designed to produce and offer the additional certainty that comes from defined parameters.

Derivatives Made Simple

Sophisticated strategies packaged into accessible investment products—available in various wrappers so you can choose what works for you and your clients.

Portfolios Built to Bend, Not Break

Build resilient portfolios that adapt to various market environments—whether you need growth, protection, or income.

Strategies that seek to deliver more certainty to modern portfolios

Our Target Outcome Investments® seek to unlock the benefits of derivatives—turning market uncertainty into more portfolio clarity and precision. With a pristine track record spanning over a decade, we engineer strategies designed to deliver what they target.

Our Featured Strategies:

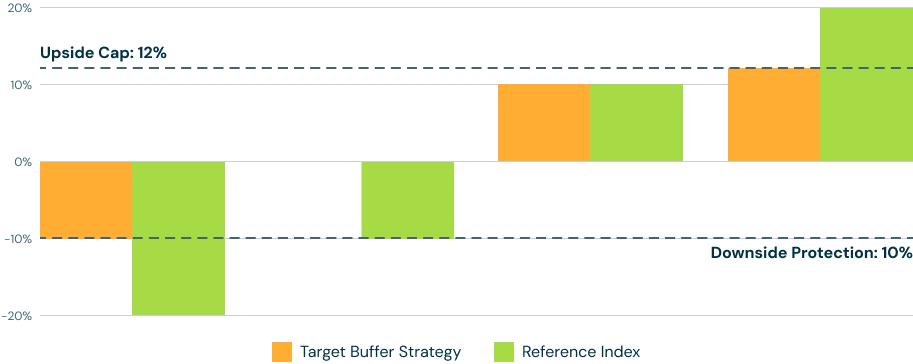

Targeting Growth with Built-In Protection

Here’s an example of the outcomes the strategy would seek over the outcome period under different scenarios for returns of the reference asset with an Upside Cap of 12% and a Buffer of 10%.

Delivering since 2012

*$50B

Assets in Target Outcome Strategies®

300+

Products with engineered precision

13

Years pioneering the defined outcome category

1

Philosophy and a pristine track record of delivery

The power of derivatives, simplified

Build more certainty into portfolios with defined outcomes.

Let’s connect